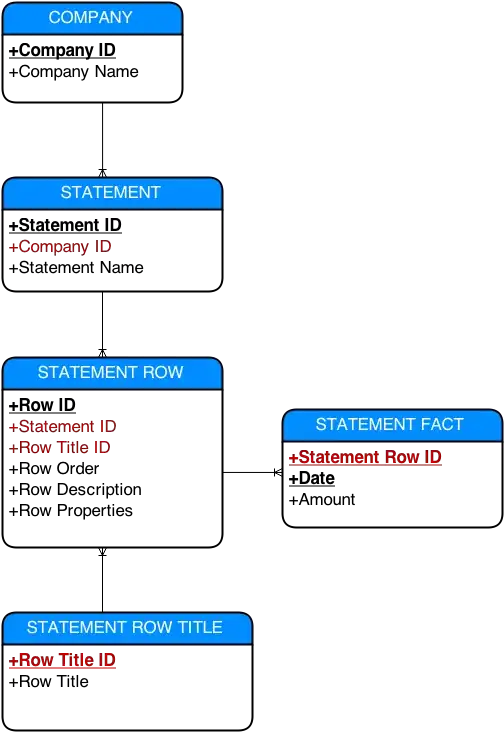

IMO, the balance sheet, income statement and cash flow tables can be the same. Here's my take on it:

-- Companies

CREATE TABLE company (

[id] int NOT NULL PRIMARY KEY,

[name] varchar(255) NOT NULL

);

-- "Balance sheet", "IFRS Income statement", etc

CREATE TABLE statement (

[id] int NOT NULL PRIMARY KEY,

[name] varchar(255) NOT NULL

);

--- "Tangible assets", "Outstanding stock", etc

CREATE TABLE statementRow (

[id] int NOT NULL PRIMARY KEY,

statementId int NOT NULL,

rowOrder int NOT NULL,

rowTitle varchar(255) NOT NULL,

rowDescription varchar(max) NULL,

rowProperties varchar(max) NULL,

FOREIGN KEY (statementId) REFERENCES statement ([id])

);

--- The facts

CREATE TABLE statementFact (

companyId int NOT NULL,

statementRowId int NOT NULL,

[date] date NOT NULL,

amount numeric NULL,

PRIMARY KEY ([date], statementRow),

FOREIGN KEY (companyId) REFERENCES company ([id]),

FOREIGN KEY (statementRowId) REFERENCES statementRow ([id])

);

Advantages of this model:

- You can have different types of balance sheets, income statements, etc, in order to cover future reporting needs

- The model defines the ordering of the rows for each statement (don't rely in an identity column for that, because you won't be able to insert rows later on)

- Using "date" instead of "year" allows you to publish statements more than once per year, i.e. per quarter or month, or even ad-hoc.

- The rowProperties field allows you to add information like if the row should be boldface, italics or other formatting properties.

- Optionally, you may want to move "companyId" from statementFact to "statement" if certain reports only apply to certain companies.